Unlocking deeper insights: Introducing INREV’s new IRR analysis tool for closed end funds

Enhancing market insights

Understanding the true drivers of fund performance is critical for real estate investors, particularly in the evolving landscape of closed end funds. The INREV IRR Index serves as a rich resource for this purpose, providing the industry with potentially the widest set of data on 285 closed end funds across Europe, with a combined paid in capital of €100 billion. To further enhance this wealth of data, INREV has developed a new IRR analysis tool to bring even more bespoke analytics for all members.

Here are the main benefits of the new IRR analysis tool:

- A custom index

The new tool allows members to use the same filter functionality as the INREV Fund Index. This enables members to not only get access to the IRR performance of standard subindexes, but also to create custom indices by combining different filters to slice and dice the data. The filters include fund style, geographical and sector strategies, domicile and target gearing. Through these new filters, members can easily define a custom index that is aligned with the strategy of a manager or fund.

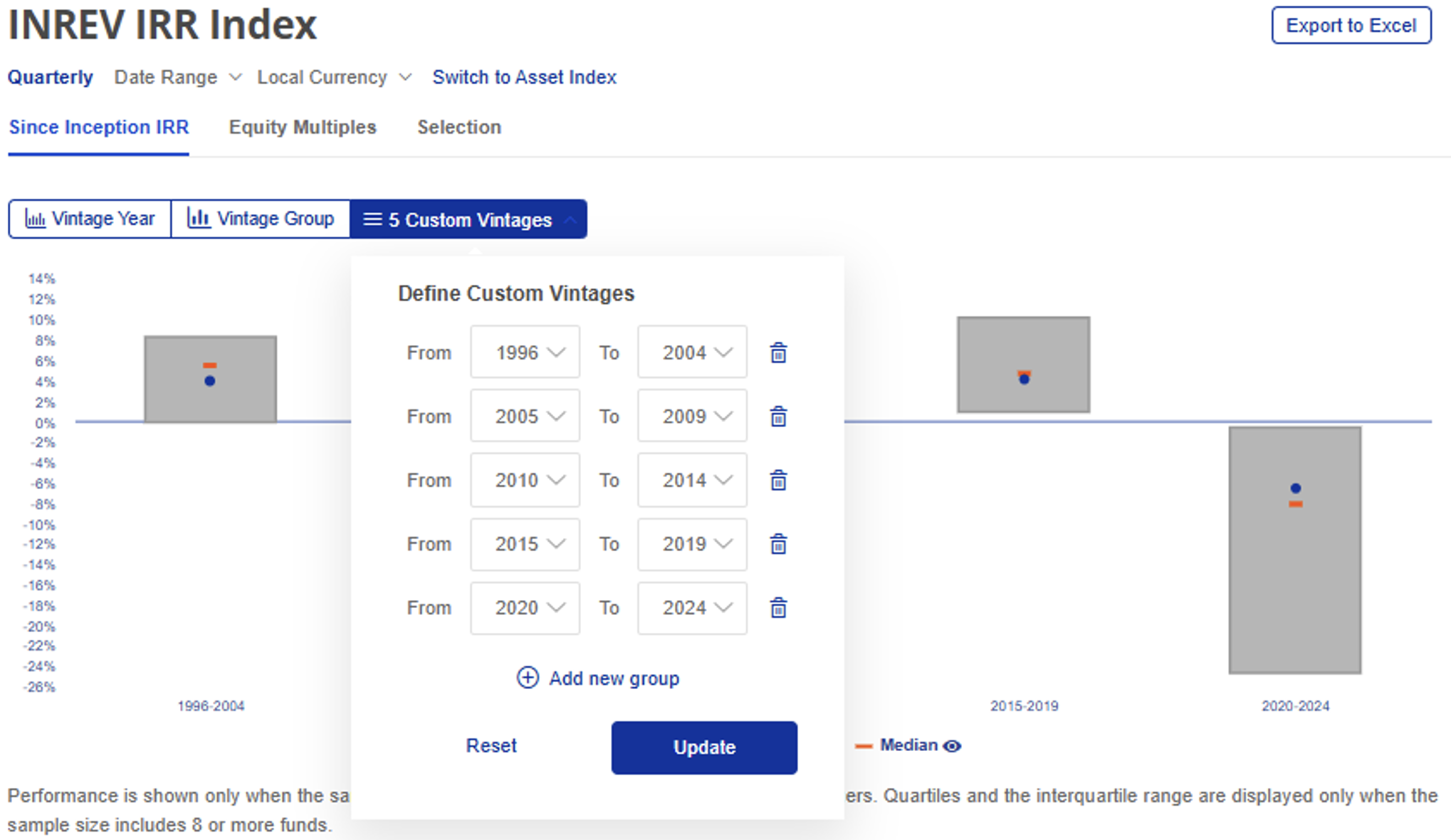

- Custom vintage groups

In some cases, the individual vintage years or standard vintage groups might not include enough funds to meet the confidentiality criteria or be relevant for the analysis that needs to be conducted. To address this the IRR tool allows users to create custom vintage groups, enabling them to review the performance in light of particular market circumstances (e.g. before and after the global financial crisis). Another use case could be to generate an IRR and equity multiples for funds with a particular vintage, including one year older and one year younger funds. Furthermore, by creating custom vintage groups, the sample of funds could be adjusted to enable interquartile IRR-ranges if the sample for individual vintage years or standard vintage groups is insufficient. The interquartile range does provide more insights into dispersion of returns, which for closed end funds tend to more than large open end funds.

- Comparison functionality

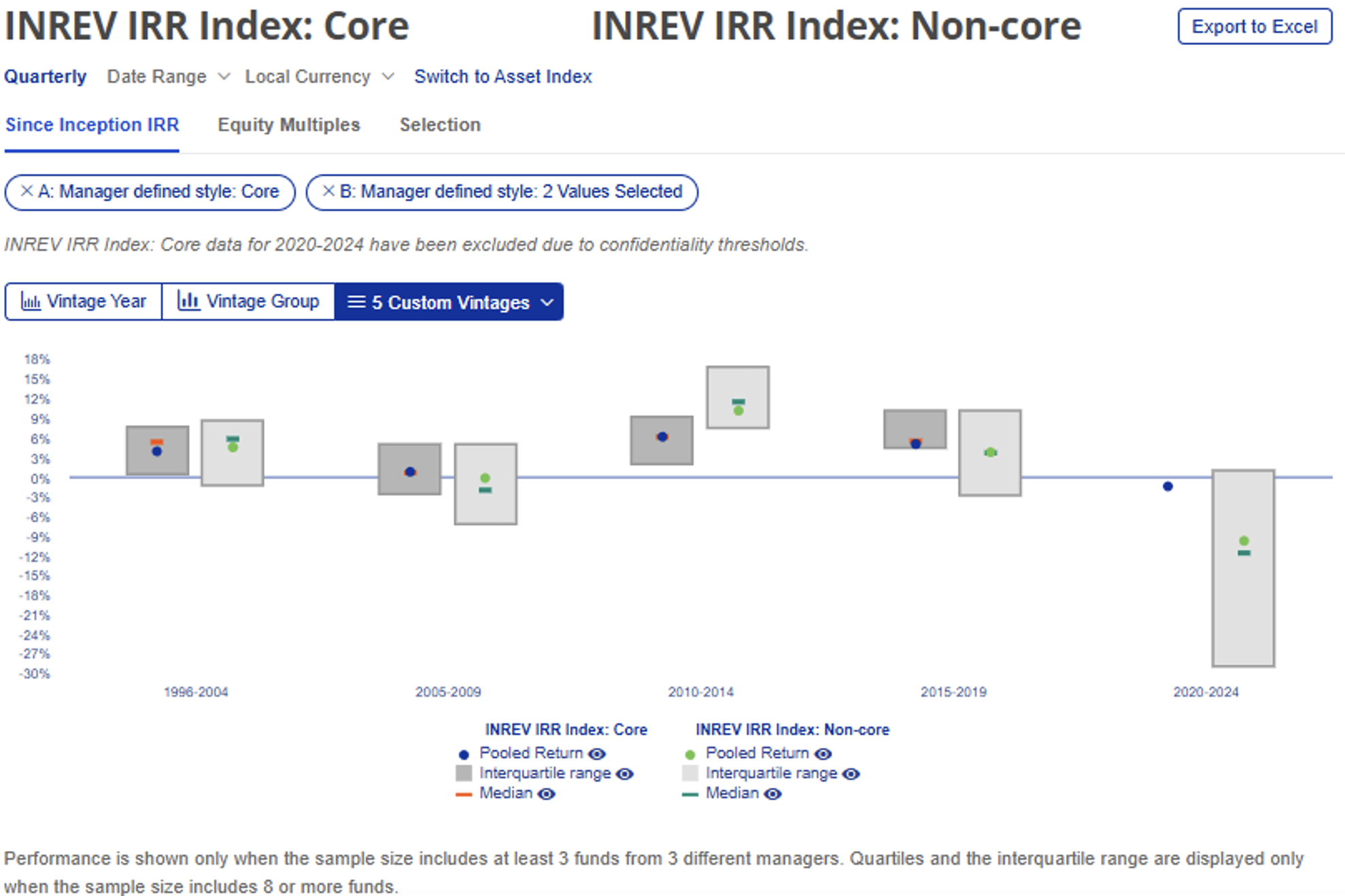

The comparison functionality serves two key purposes: market analysis and peer group comparison.

Market analysis: Users can gain market level insights by comparing the performance of two different segments of the market (e.g. multi vs. single country or core vs. non-core). To do this, users must select the ‘INREV IRR Index’ in both menus and apply relevant filters.

Peer group comparison: Users can compare a single group or group of funds from ‘My vehicles’ and compare that to the ‘INREV IRR Index’. Both menus offer detailed breakdowns and filtering options for more precise analysis.

Similar to the other analytical tools, the output can be used to make more informed and better investment decisions or to report (relative) performance to investors.

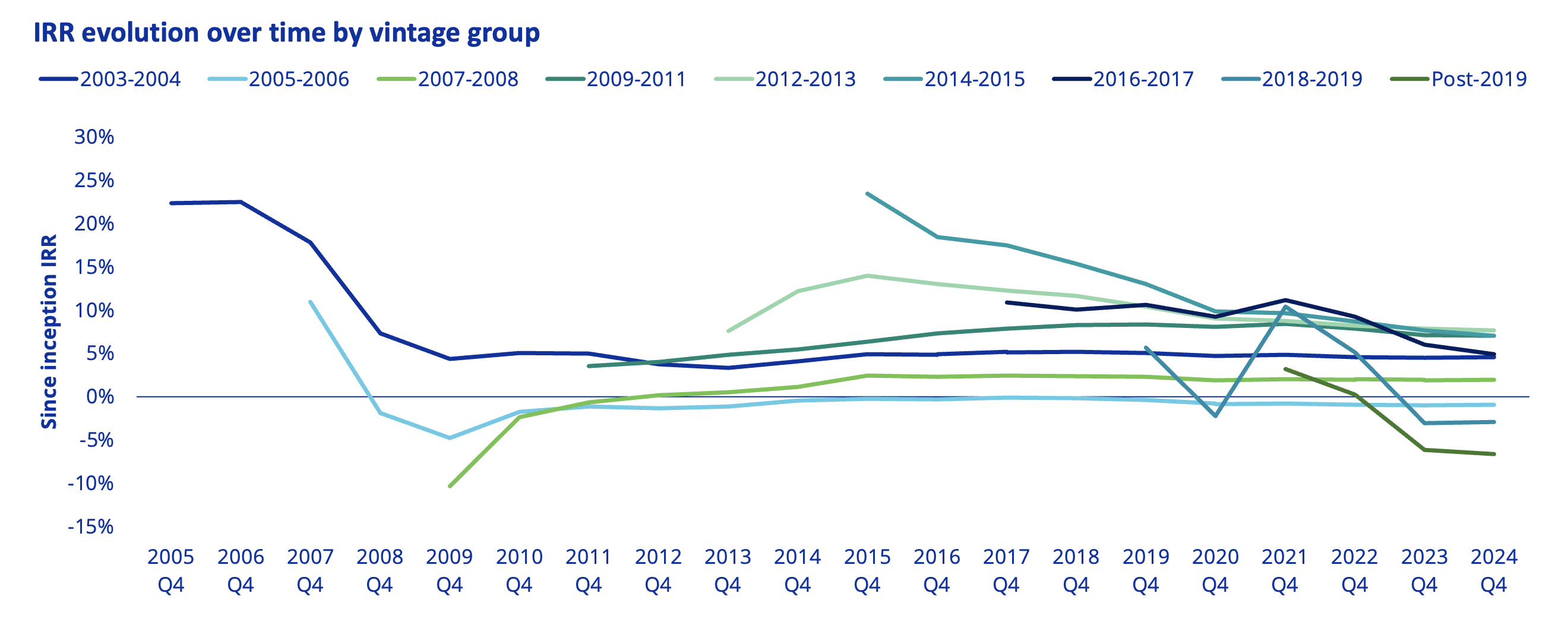

- J-curve analyses

Beyond the insights that can be obtained directly from the tool, members can also obtain bespoke analytics. One of the possibilities that is accommodated for is the since inception IRR by vintage until a particular point in time. The date range filter allows users to select an ‘end date’ for the analysis that they’re running. This enables users to analyse the evolution of the IRR over time, which can provide useful insights into the potential existence of a J-curve effect or the impact of certain market events on performance.

As investors seek greater clarity in performance assessment, this new IRR analysis tool compliments the existing suite of resources INREV offers, bringing more transparency and deeper analytics not only for core and open end funds, but also closed and value add opportunistic funds.

If you would like to understand more about the new IRR tool or the wider fund-level indices, please contact the INREV Research team.