Enhancing performance insights: new Asset Level Index analytics

Determining performance drivers

As real estate investment strategies become increasingly data-driven, gaining deeper insights into asset-level performance is more critical than ever. To support this, INREV has expanded the Asset Level Index with new outputs, enabling all data-providing investment managers, multi managers and investor members to better understand asset-level performance drivers. Covering assets across Europe with a combined value exceeding €190 billion and over 10 years of historical data, the Asset Level Index’s new outputs will provide a more granular view of returns, helping industry professionals make more informed investment decisions.

Here are three main benefits of the new outputs:

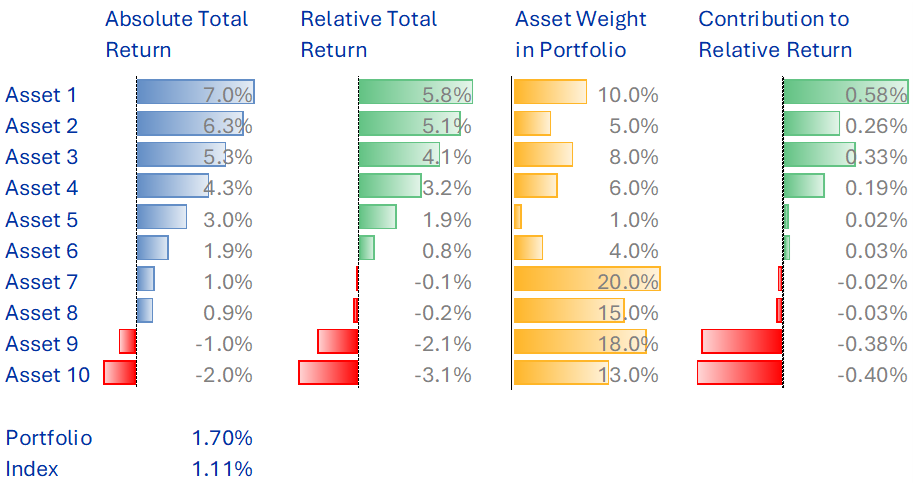

1. Asset level contribution

Using the contribution analysis output, members will be able to understand how individual assets are performing compared to the asset level index, and which assets are driving the portfolio’s absolute- and relative return. These insights can be obtained at the wider portfolio level or at fund/vehicle level, but also for a selection of assets within the portfolio (e.g. country, sector or a combination of any of these). In addition to the individual asset contribution, assets can also be grouped together to understand how different segments within the selection of assets have contributed to the absolute and relative performance.

2. A new layer of granularity

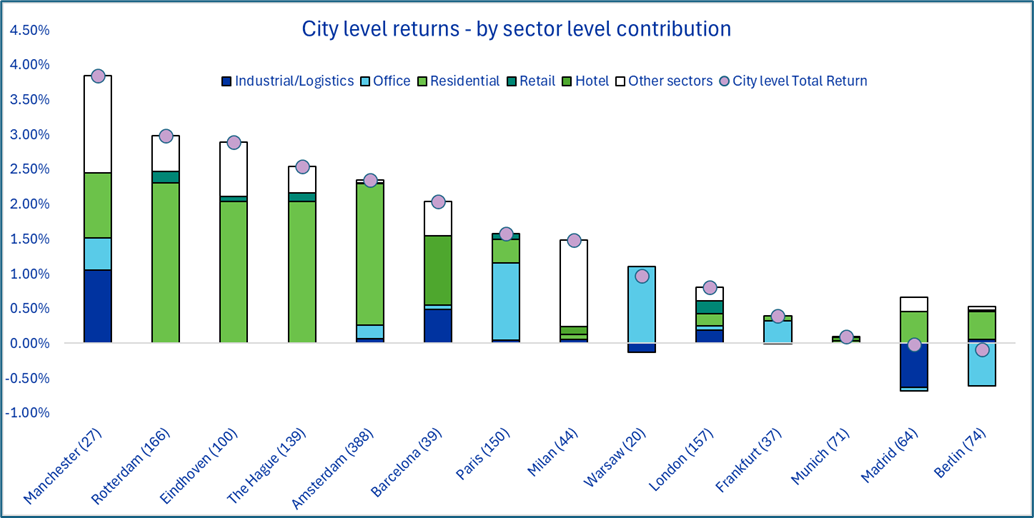

The new outputs contain an extra layer of granularity through the addition of city level information. Based on the current coverage, data for over 150 cities is already available in a single download. This enables members to slice and dice in more detail and get an even better understanding of performance drivers. Beyond the inclusion of city level data at sector level, the new outputs also introduce the concept of regional (e.g. Nordics or Southern Europe) segmentations.

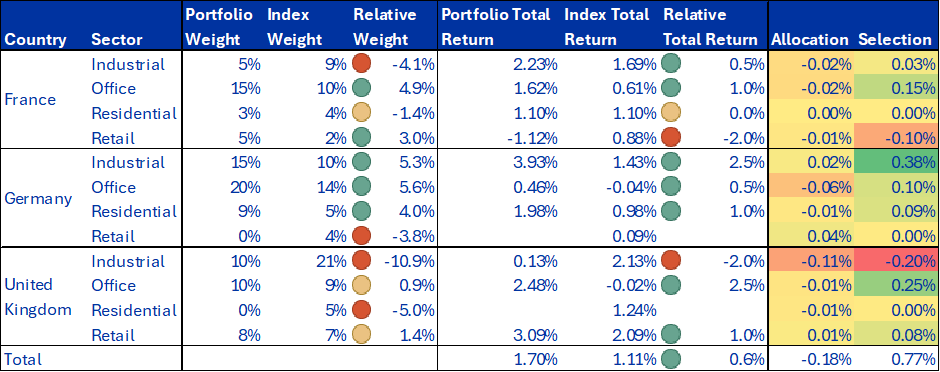

3. Performance attribution

The new attribution output contains all the building blocks and a step-by-step guide that enables members to perform an attribution analysis. This type of analysis will help members to better understand what is driving the relative performance of a portfolio or a selection of assets. The outcome results in an allocation effect and a selection effect.

The allocation effect explains if the impact of allocation decisions were positive or negative. It will be positive in the case of overallocation (compared to the index) to countries/sectors that are outperforming the wider market or underallocation to underperforming segments.

The selection effect explains if the impact of asset selection was positive or negative. A positive score indicates that the assets in the portfolio or the selection of assets have outperformed the assets in the index for the same country/sector.

For the analysis it is important to have a clear approach in mind:

- Define which assets you would like to compare. This could be all assets in the wider portfolio, a particular fund/vehicle or a selection of assets (e.g. country, sector, fund or a combination of any of these).

- Define the universe (custom index) you would like to compare. This ideally should be aligned with the overall strategy or mandate you have linked to the selection of assets to ensure a like-for-like comparison.

- The selection of the segmentation is important for carrying out relevant attribution analyses. The segmentation used for the analyses could be based on geographical or sector segments or a combination of both. It is important that the segments add up to the total universe as defined above. Another important consideration for the segment is that they are easily recognisable and are relevant based on their size. The segmentations could also be linked to industry standards, the strategy of a fund and/or target allocations.

Through these additional outputs and analytical possibilities, INREV aims to further improve transparency and professionalism across the European non-listed real estate industry. These insights can be used by members for internal analyses, investor reporting or research purposes.

If you would like to understand more about these new asset level index outputs or the wider index, feel free to reach out to the INREV Research team.