European living sector outperformed wider fund index in both short- and long-term

The living sector is certainly grabbing attention in Europe’s non-listed real estate landscape. The newly launched INREV Living Fund Index provides a new layer of transparency supporting investors and investment managers to make better-informed decisions on the growing living real estate segment.

The new index, including 12 subindices and an intuitive online analysis tool, provides insights not just on the performance of non-listed living funds but can also be used for comparison, investment and allocation decisions and for research purposes.

Living Funds have a self-defined sector strategy to invest in residential and/or student housing, encompassing multi-family, single-family, social housing and student housing assets, as well as senior living designed for a stay of over one month with no health services provided.

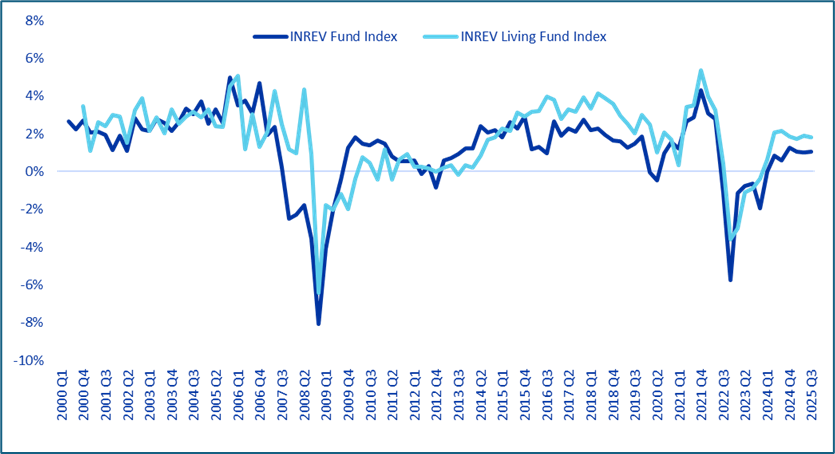

Living outperformed on both short- and long-term basis

With 25 years of historical data, the Living Fund Index offers a comprehensive view of historical performance in this segment. And the results speak for themselves: showing living funds have outperformed the wider Fund index not only in recent quarters but consistently over time. The Q3 2025 release includes 38 residential funds and 3 student housing funds with a combined Gross Asset Value (GAV) of €60.4 billion.

Source: INREV Fund Index and INREV Living Fund Index

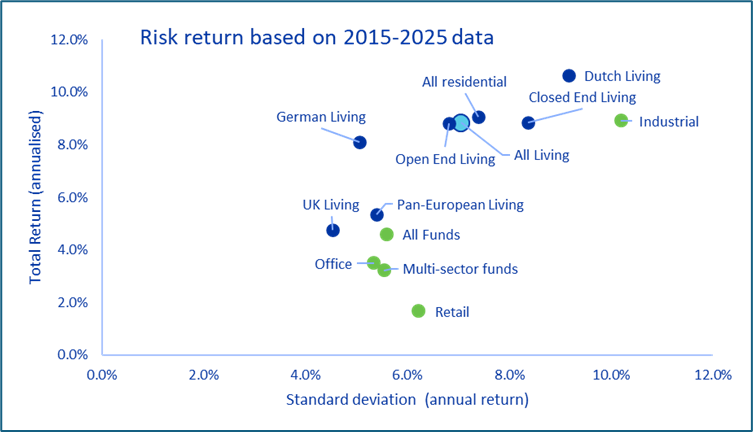

Strong risk-adjusted returns over the last decade

Beyond performance, the index can be used to analyse subindices and investment risk (measured by the standard deviation of returns).

Over the past 10 years, the Living Fund Index delivered an attractive risk-return profile, outperforming the wider Fund Index—including office and retail funds. While industrial/logistics funds posted slightly stronger returns, their returns were more volatile.

Within the Living Index, various subindices show large differences in risk and return profiles. UK living funds reported low risk and returns, while the Netherlands-focused funds showed higher returns and risks. German living funds generated a return similar to the Living index, but with lower risk based on the standard deviation. Pan-European living funds underperformed in the Living index with lower risk, but outperformed the wider INREV Fund index and its multi-sector subindex.

Source: INREV Fund Index and INREV Living Fund Index

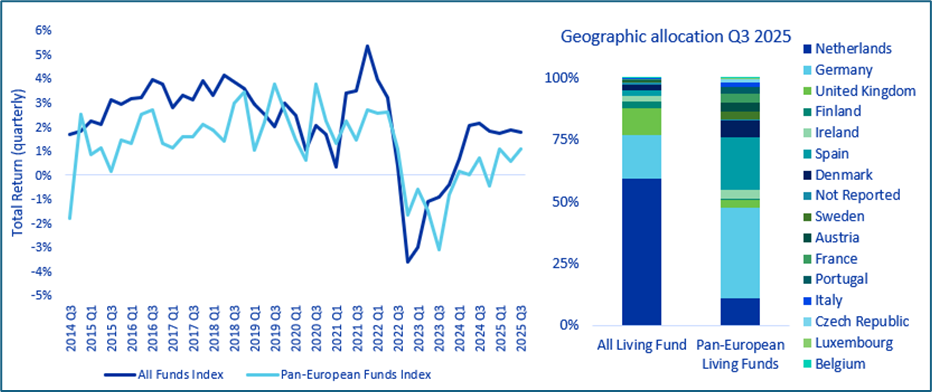

Pan-European funds offer diversification

The Living Fund Index includes a mix of single country funds, pan-European and other multinational funds, giving investors a wide lens on the market. The Netherlands stands out with the longest performance history dating back to 2001, demonstrating the maturity of the Dutch market with 9 pooled institutional funds representing a combined GAV of €34.9 billion of the Living index’s total €60.4 billion in Q3 2025. Germany follows with 8 funds and a combined GAV of €8.8 billion, followed by the UK with 4 funds and a combined GAV of €6.4 billion.

But one of the most notable shifts over the past decade is the growth of pan-European living funds. They have grown from 4 funds in 2015 to almost 20 funds in 2025. Due to lagged reporting, the Q3 2025 sample comprises 14 pan-European funds with a combined GAV of €7.0 billion.

For investors who traditionally focused on single country funds, pan-European funds offer the value of geographic diversification in their portfolio. These funds are more diversified geographically than the wider living index, which has an allocation of over 50% in the Netherlands. In the past 11 years, the geographic diversification of Pan-European funds resulted in lower volatility. In contrast, single country funds could be more impacted by national (or even local) regulation changes.

Source: INREV Living Fund Analysis tool

If you would like to learn more about the INREV Living Fund index and tool, please reach out to the INREV team, including Bert Teuben or Giulio Cappelloni.