Real Estate in the time of COVID-19

A Turbulent Year Brings Focus on Resilient, High Quality Income

2020 has been a year like no other. In the midst of recurring lock-downs across Europe, the Real Estate market continues to react to repeated changes in its access and use. For the first time, stakeholders in commercial (and to a certain extent residential) buildings have been unable to visit the physical space that they occupy, manage and own.

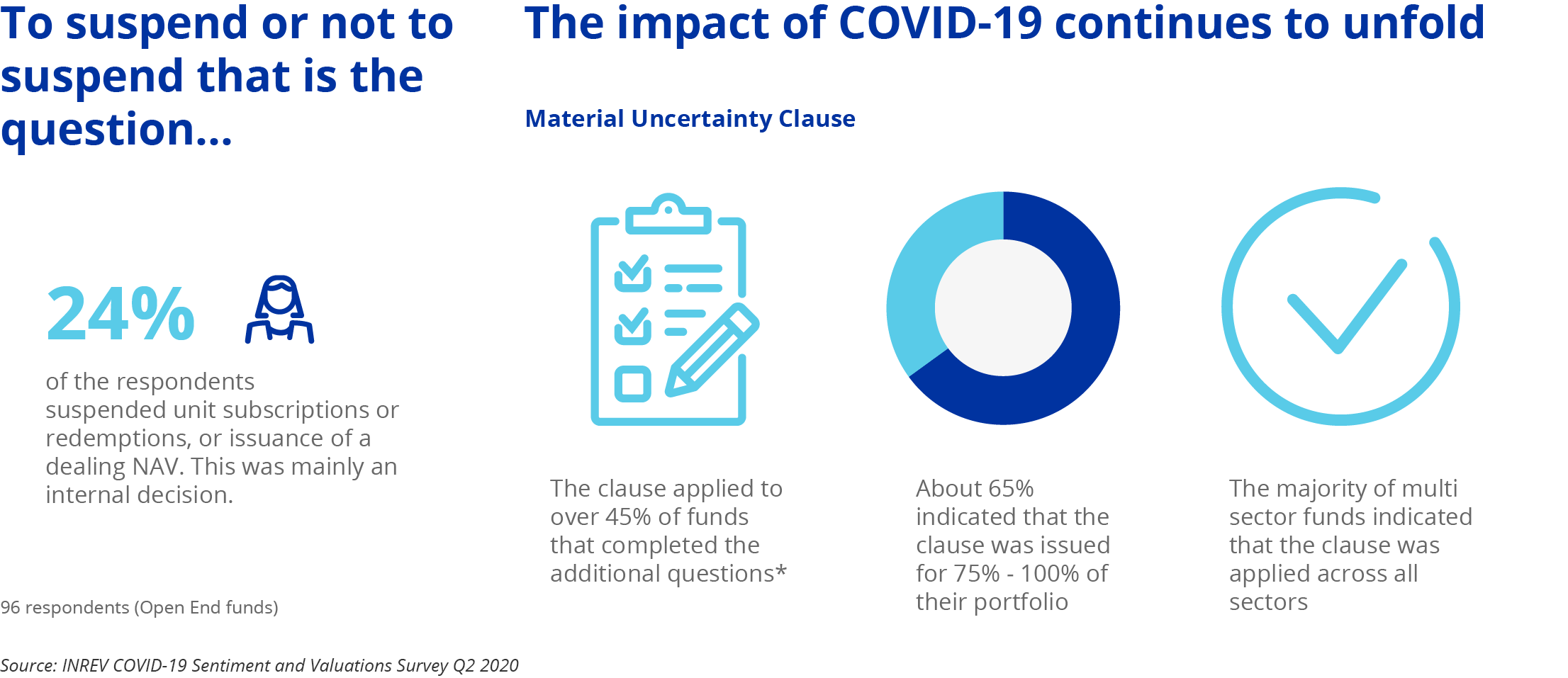

This unprecedented environment is an extreme stress test on; 1) valuations, as a result of limited transaction activity in the year to date and 2) what is typically a contractually guaranteed income stream through the lease structure. The lack of transactional evidence meant the valuer’s Material Uncertainty Clause was applied to 57% of Funds that responded to the INREV Valuation Survey in Q1 and reduced to a still significant 45% in Q2. Of the 96 open end Funds across Europe that INREV surveyed, 24% suspended unit redemptions or subscriptions in Q2 2020.

2020 has been a year like no other. In the midst of recurring lock-downs across Europe, the Real Estate market continues to react to repeated changes in its access and use

The liquidity discussion has been high on the agenda in recent years, spurred by investor experiences through crises such as the GFC and the BREXIT referendum when Funds suspended trading in a similar fashion. Recently, for example, The Financial Conduct Authority in the UK is mid consultation regarding improved disclosure and notice periods for redeeming capital in property Funds. (See INREV Response here)

Real Estate is an illiquid asset class and, at times of stress, can be difficult to trade unless offered at significant discounts. In these circumstances, whilst frustrating for some, it can be prudent for a manager to suspend redemptions (and subscriptions) in the best interests of remaining investors. In “normal” circumstances, over the lifetime of an investment, the required level of liquidity stated by Funds are generally manageable and thus beneficial to investors.

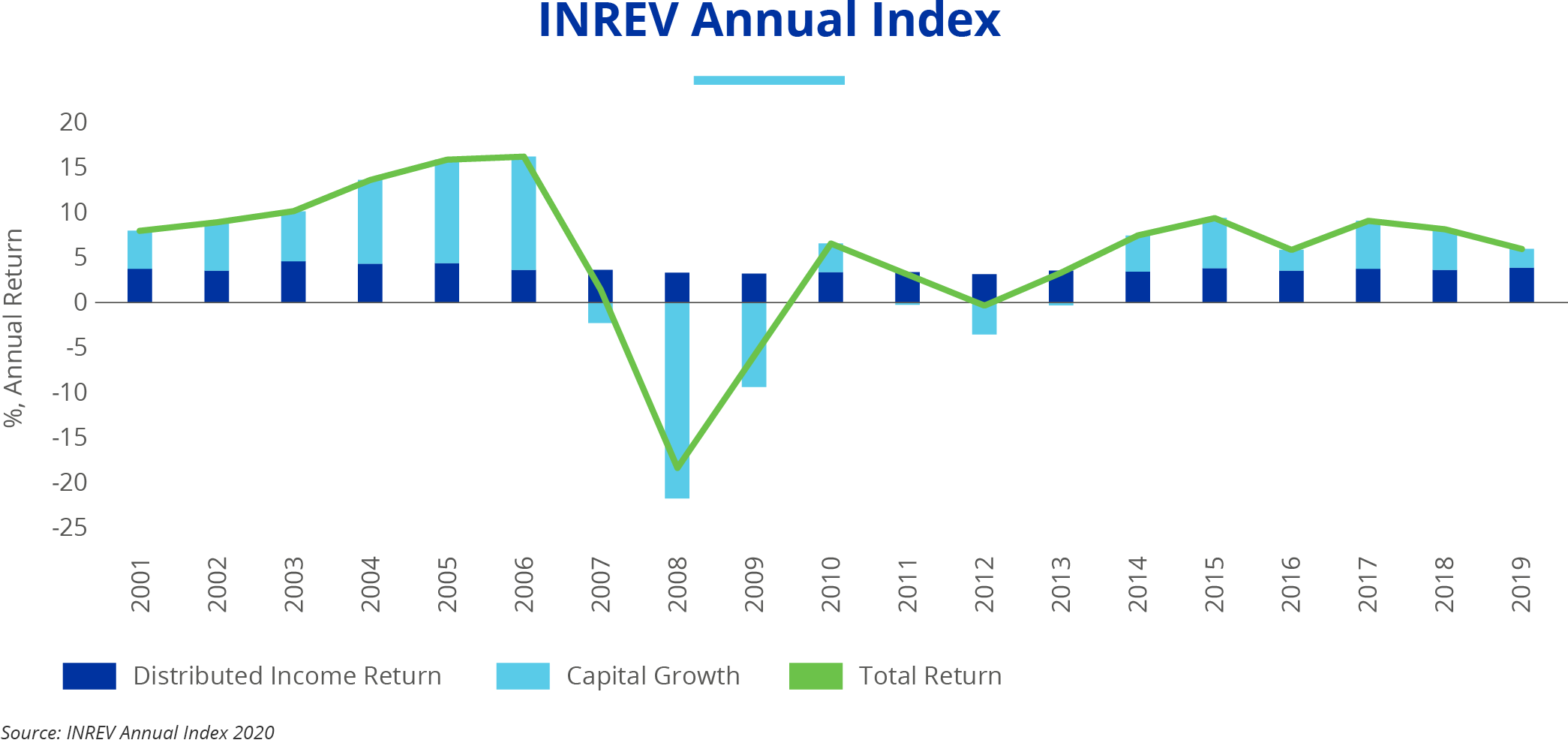

The asset class is a long-term investment and in core strategies predominantly held for income, so trying to “time” the market cycle is generally ill advised. This is demonstrated by studying the INREV Annual Funds Index where over the long term (since 2001), the annualised distributed income return (3.8%) accounts for 69% of the total return (5.5 %).

The asset class is a long-term investment and in core strategies predominantly held for income, so trying to “time” the market cycle is generally ill advised

These returns suggest the Real Estate illiquidity premium provides an attractive yield over more liquid, fixed income investments. INREV fund level returns demonstrate that despite challenging periods, through market cycles the asset class has offered an attractive risk/return reward often sought out and beneficial to multi asset class portfolios. It is important to consider that through a commingled vehicle, investors can receive the diversification advantages of an asset class they would otherwise struggle to access, given the relatively small lot size allocations.

Given the importance of income, in times of crisis, investors’ focus is heightened on the security of cashflows, while governments across Europe have taken different approaches to provide support for tenants and businesses that occupy buildings. From an investor’s perspective, measuring the income received on a quarterly basis in 2020 has become vital in understanding the relative performance of their real estate assets. There has been a huge focus on rents received vs contracted across the industry, according to the INREV COVID-19 Sentiment Survey conducted in May which recorded average rents received being as low as 51% for the retail sector, but as high as 96% for both industrial/logistics and residential sectors.

The impact on the various real estate sub sectors has been the topic of much debate throughout 2020 but perhaps most of all, the future of offices. Demand is likely to be challenged in the near term with forced economic contraction and the clear ability for many businesses to work largely successfully from home. However, there will be a requirement for collaborative, physical working environments in the long term. Arguably this is where a polarisation between prime and secondary assets is often seen after a market downturn.

While it is still early in the current cycle, and despite the challenges, we have seen some transactional evidence of offices in prime locations sold and let across Europe at record values. Unlike the GFC, caused by an abundance of leverage and significant supply, the cause of this downturn is different. Given the significant supply/demand imbalance that existed pre COVID in prime markets, this early transactional evidence shows there is still strong investor appetite for well-located assets let to resilient tenants.

While it is still early in the current cycle, and despite the challenges, we have seen some transactional evidence of offices in prime locations sold and let across Europe at record values

At time of writing, the immediate future remains uncertain with a continued reduction of access to physical buildings around the world. This has led to an uncertainty around the value, income certainty and liquidity of Real Estate as with previous cycles. While a contraction in demand is highly anticipated, the limited supply of quality assets in good locations is likely to prove resilient in terms of tenant demand over the long term and the resulting returns (based on income) should provide a positive risk adjusted reward for investors.

This article was written by Douglas Rowlands, Director of Client Portfolio Management, Invesco, and Member of the INREV Performance Measurement Committee